Santa Fe Growth

The hikes and falls and spasms that describe various moments in the real-estate industry during the last five years make market analyses and predictions in “the old days” seem like child’s play. It’s no wonder that experienced professionals like Cate Adams (in the Santa Fe office of Sotheby’s International Realty) find themselves relying on one simple statement when asked why Santa Fe is taking so long to recover from the crash: “I don’t know.”

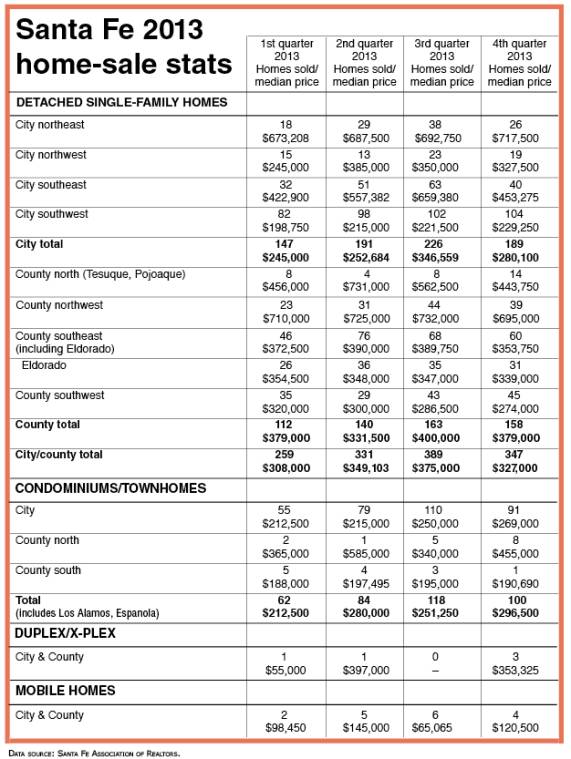

The fourth-quarter report from the Santa Fe Association of Realtors says both sales volume and home prices “were broadly higher across the nation, while foreclosure loads, the number of homes for sale and the number of days it took to sell a home were all much lower. Multiple-offer situations became commonplace again and prices in many areas rallied to multi-year hghs.”

Rising home prices based on stronger demand would signal recovery in this market, but that’s not yet happening in Santa Fe. “I see an improvement in the attitude of buyers and their confidence in the market, but there’s really very little improvement in pricing,” Adams said. “Prices are staying flat.”

A year or two ago, many brokers said their clients were waiting for the market to hit the bottom, not wanting to buy if prices were going to sink more. That refrain is much less common today. “That’s right. Nobody’s talking about it anymore; everybody’s talking about the improvement in numbers,” Adams said. “Sales are up, prices are not. Everybody’s saying that across the board. Why is Santa Fe so slow to recover? I don’t know. We were obviously very much affected by the real-estate bubble, if there was such a thing.”

As home sales began to fall off in many U.S. markets — after the subprime mortgage crisis and the September 2008 collapse of Lehman Brothers, AIG, and other investment firms — some began to worry that Santa Fe’s “bubble” was about to burst as most obviously happened in Phoenix, Las Vegas, Nev., and other municipalities that had seen dramatic housing-industry spikes.

“Our market is not nearly as large as Phoenix and Las Vegas,” Adams responded. “We have a much smaller buyer pool, and we have a very specific appeal, which is why we all live here. And I’m not sure we would want to get back to 2005/2006. The market was artificially inflated by the bad-mortgage issues. There was a bit of a frenzy, too, as prices continued to spiral upward: a frenzy to get into the market, which unfortunately too many people are paying for now.

“I think the issue of why prices aren’t increasing commensurate with sales is that we have to look at price points, not the market as a whole. Looking at the overall median prices and average prices in Santa Fe doesn’t really tell you that much.”

Another window into Santa Fe’s real estate scene is the construction business. Builders have not responded to the idea of a healthier market; this is evident in the low numbers of building permits issued recently by the city of Santa Fe and Santa Fe County.

Adams said it is an unfortunate reality that home prices have dropped and the cost of building materials has gone up. “That is a significant factor in new construction. Also, the banks are much more careful” than they were before about financing homebuilding and homebuying.

Her husband, owner of Ron Adams Construction, has compensated — as have most other builders — by focusing more on remodeling jobs. “There’s a wonderful market for remodeling in Santa Fe,” she said.

Cate Adams is optimistic about 2014. “Actually 2013 was a great year for me — not what I would have called great in 2007, but I was busy the entire time and successful in getting things closed, which had been an issue.”

That’s a positive sign, that buyers are deciding to complete the process, and that banks are permitting it.

“It’s a complicated issue,” Adams said about Santa Fe’s recovery. “We can look at the statistics and talk about what we believe is going on, but that’s about it.”

It’s always fun to look at stats and try to figure everything out. Here are a few highlights from Santa Fe County Real Estate 2000-2013, a report released recently by Barker Realty:

According to Barker figures, residential sales decreased by 47 percent from the 2005 high of 2,290 sales to just 1,213 in 2009, the year after the onset of the recession; home sales had climbed back up to 1,767 last year. The shift in sales of land parcels was even more dramatic: an 80 percent drop (658 to 133) from 2005 to 2009, and the activity level increased only to 195 sales in 2013.

In his blog, Realtor Alan Ball (Keller Williams Realty) recently wrote that 2013 “came out a bit better than 2012, but only in small increments. The fact that we had positive numbers is not to be missed, but they were not big numbers and the improvements were in single digits.

“ ‘Increase in annual unit sales for Santa Fe residential real estate,’ said the headline. How much of an increase? For unit sales, it was 7 percent,” Ball wrote. “This is considered a good number for most. Some might wish to see a double-digit increase, as has taken place in other markets. But Santa Fe is just a tortoise compared to the hare of Phoenix or Denver. Our increases are steady and historically have built a solid foundation for future growth rather than race up and down the course setting higher and lower records every few years.

“A growth in home sales is a sign that some sellers were finally able to get beyond the burden of owning a home that they formerly could not sell. And since very few new homes are being built, the inventory that did sell had a very high percentage of existing homes.”

What to expect for 2014? “The real estate experts all agree that interest rates will climb, which will certainly keep a lid on our ongoing market recovery,” Ball continued. “The pressure for newly built housing will increase as the ‘quality’ homes in the existing inventory continue to sell. The best ones sell first, you know. And land sales and spec building will still be virtually dormant as mortgage lenders are still hanging back and builders still are nursing wounds from recent market conditions.”

David Dougherty, Dougherty Real Estate, is principally involved in the commercial real estate realm. That’s been all about “musical chairs” lately, he said, “people moving around Santa Fe because of better prices and better locations, but I wouldn’t say the market is healthy because there’s no new demand. Part of the problem is that there is a lot of really aged product out there that is becoming obsolescent. In the historic district it’s going to take enormous amounts of money to either remodel it or refurbish it, or it just has to be torn down. It can be two or three times more expensive to refurbish than to tear down and rebuild.”

Also in the Dougherty firm are brokers Clara Dougherty, Jennifer Tomes, and Warren Thompson, who concentrate on the residential segment of the market. About that, David said he has a theory: “We are dependent on other markets and always have been. It takes the other markets improving over a period of time

and a development of comfort there before people can sell their homes in Chicago or L.A. and find that Santa Fe is a real bargain. That’s how we started in the 1990s, particularly the California buyers who were selling their houses for terrific amounts of money and seeing Santa Fe as a wonderful bargain. I’m slightly optimistic that as those markets improve we will see improvement here.”

At present, inventory is just under 2,000 homes on the market in the Santa Fe area (down from about 3,300 before the crash). “From what I’m hearing from our agents, it seems to me that the very good stuff has been bought up and now we’re getting to where finding quality product — well-designed, well-built homes — is a little more difficult.”

Santa Fe’s draw — hinging on the climate, the unique architecture, the intermingling of three cultures, the art market, The Santa Fe Opera, and other factors — is a powerful constant. There are few negatives, but one of them that has become more significant in recent drought times is the impact of forest fires: definitely bad publicity for people thinking about buying in Santa Fe. “Yeah, if we have another bad fire season, all bets are off,” Dougherty said. “The reason a lot of people come here is the beautiful blue skies and clean air, and fires just eliminate all that.”

Asked for his outlook for 2014, he said he is not optimistic about the commercial real-estate market. “In the residential, I’m cautiously optimistic that those buyers in other markets will perceive our value and become more serious buyers.”

The lookie-loo phenomenon — people going out to look at houses with no real intention of buying, basically making a hobby out of it — appears to be subsiding.

“I do think the lookers got a little spoiled in 2009, 2010 and 2011 in that they would go out to look at houses thinking the market was still going down so they weren’t that serious. I do think we’ve reached the bottom, but some potential buyers aren’t convinced. They’re still thinking, ‘It’s overpriced. I’ll wait a while for it to come down.’ But I think those days are gone.”

By Paul Weideman

(505) 660-4299

BARKER REALTY

530 S. Guadalupe Street

Santa Fe, NM 87501

![]() All real estate advertised herein is subject to the Federal Fair Housing Act and Equal Opportunities Act. Barker Realty Co., llc. strives in to confirm as reasonably practical all advertising information herein is correct but assumes no legal responsibility for accuracy and should be verified by Purchaser. Barker Realty Co., llc. is not responsible for misinformation provided by its clients, misprints, or typographical errors. Prices herein are subject to change. Square footage amounts and lot sizes are approximates. The data relating to real estate for sale in this web site comes in part from the Internet Data exchange ("IDX") program of SFAR MLS, Inc. All data in this web site is deemed reliable but is not guaranteed.

All real estate advertised herein is subject to the Federal Fair Housing Act and Equal Opportunities Act. Barker Realty Co., llc. strives in to confirm as reasonably practical all advertising information herein is correct but assumes no legal responsibility for accuracy and should be verified by Purchaser. Barker Realty Co., llc. is not responsible for misinformation provided by its clients, misprints, or typographical errors. Prices herein are subject to change. Square footage amounts and lot sizes are approximates. The data relating to real estate for sale in this web site comes in part from the Internet Data exchange ("IDX") program of SFAR MLS, Inc. All data in this web site is deemed reliable but is not guaranteed.

Design By SantaFeWebDesign.com